2815353107 Key Strategies for Building Wealth in 2025

In 2025, wealth-building strategies are set to evolve significantly. Digital investments and cryptocurrencies are gaining traction, with a notable percentage of investors diversifying their portfolios. Concurrently, sustainable and impact investing is aligning profit with purpose. Additionally, the emphasis on multiple income streams underscores the importance of financial resilience. Understanding these trends will be crucial for individuals seeking to navigate the complexities of modern finance. What implications do these strategies hold for future investors?

Embracing Digital Investments and Cryptocurrencies

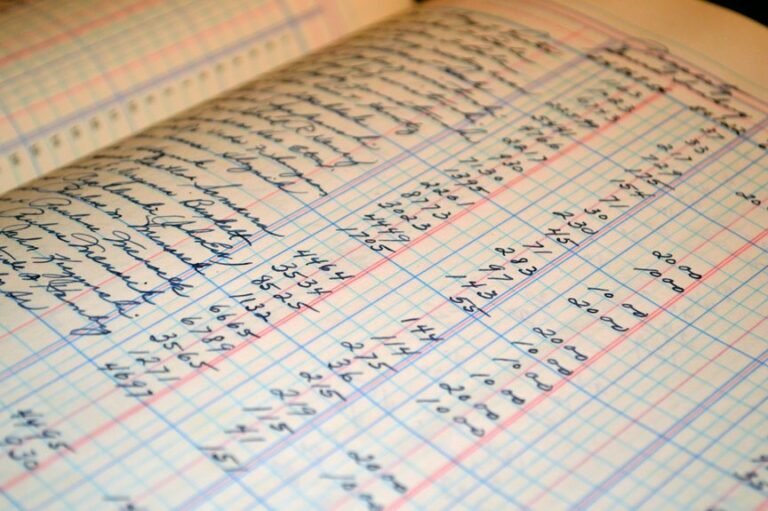

In 2025, an estimated 30% of investors are expected to allocate a portion of their portfolios to digital assets, including cryptocurrencies.

This shift necessitates the use of digital wallets and crypto exchanges, which facilitate secure transactions and access to diverse assets.

Strategic engagement in these platforms enables investors to harness potential gains while navigating the evolving landscape of financial freedom and decentralized finance.

Focusing on Sustainable and Impact Investing

Sustainable and impact investing has emerged as a crucial focus for investors seeking to align their financial goals with ethical considerations.

By prioritizing ethical investing, individuals can support initiatives that promote environmental sustainability and social responsibility.

Green bonds, specifically, offer a strategic avenue for financing projects that yield positive ecological impacts while potentially delivering competitive returns, appealing to a growing demographic invested in long-term, meaningful outcomes.

Developing Multiple Income Streams and Passive Income Strategies

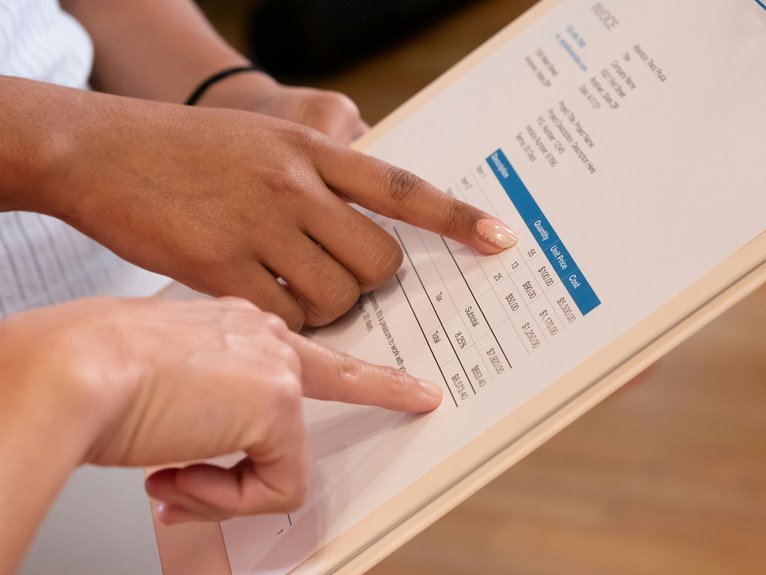

Investors increasingly recognize the importance of diversifying their portfolios not only through sustainable and impact investments but also by developing multiple income streams.

Engaging in side hustles and investing in real estate provide avenues for passive income, allowing individuals to leverage their time and resources effectively.

Conclusion

In conclusion, the path to wealth in 2025 is marked by strategic engagement with emerging digital assets, as 30% of investors are projected to diversify their portfolios with cryptocurrencies. Additionally, the emphasis on sustainable investing reflects a growing awareness of social responsibility, while the pursuit of multiple income streams underscores the need for financial resilience. Adapting to technological advancements and market shifts will be crucial for investors seeking to navigate this dynamic landscape effectively.