5186205183: Investing in Startups – Risks & Rewards

Investing in startups involves navigating a complex landscape of potential rewards and inherent risks. The unpredictable nature of emerging markets poses challenges that require careful evaluation. Investors must consider factors such as market volatility and competitive dynamics. Additionally, understanding the startup lifecycle can be crucial for informed decision-making. As the dialogue unfolds, the implications of these elements on investment success become increasingly evident, prompting a closer examination of effective strategies.

Understanding the Startup Ecosystem

Understanding the startup ecosystem is crucial for investors seeking to navigate this complex landscape effectively.

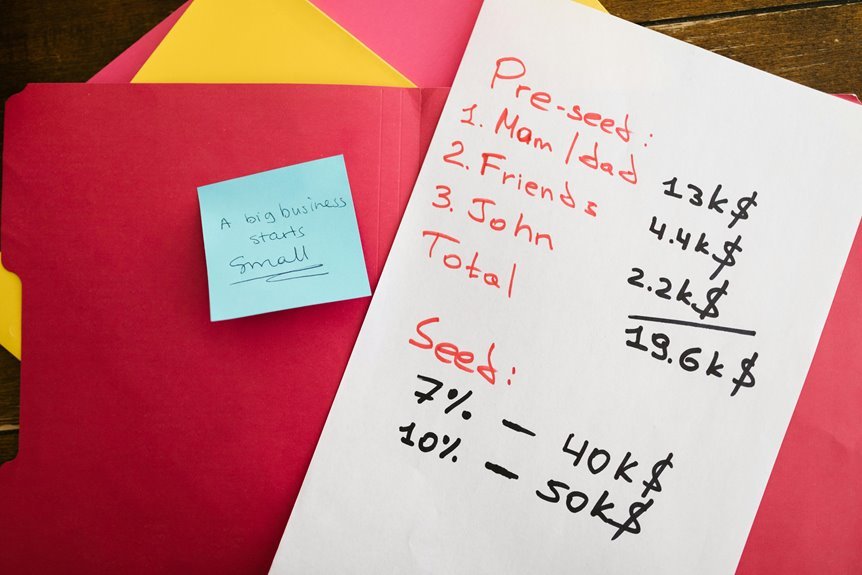

The startup lifecycle comprises several funding stages, each presenting unique opportunities and challenges. Investors must stay attuned to market trends that influence valuation and growth potential.

Their roles extend beyond capital provision, encompassing mentorship and strategic guidance, essential for fostering innovation and driving successful outcomes in emerging ventures.

Evaluating Risks in Startup Investments

How can investors effectively assess the myriad risks associated with startup investments? By conducting thorough due diligence, they can identify factors such as market volatility and competitive landscape pressures.

Evaluating financial health, management expertise, and market demand helps investors understand potential pitfalls. This analytical approach ensures that investors are better prepared to navigate uncertainties, ultimately aiding in informed decision-making regarding startup funding.

Strategies for Maximizing Returns

Investors seeking to maximize returns on startup investments can employ a range of strategic approaches that emphasize both innovation and market alignment.

Effective diversification strategies mitigate risk by spreading investments across various sectors, while well-defined exit strategies ensure timely and profitable divestment.

Conclusion

In conclusion, investing in startups offers both substantial risks and potential rewards, necessitating a careful approach. Notably, approximately 90% of startups fail, underscoring the importance of thorough due diligence and risk assessment. However, with effective strategies such as diversification and active founder engagement, investors can enhance their chances of success. By understanding the dynamics of the startup ecosystem and adapting to market changes, investors can navigate uncertainties and optimize their investment outcomes in this volatile landscape.