8666201302: Key Factors for Picking Profitable Stocks

Identifying profitable stocks requires a systematic approach. Investors must scrutinize financial health through key performance metrics. Additionally, understanding prevailing market trends and economic indicators is crucial. Evaluating competitive positioning within an industry can further clarify a company's potential for growth. These factors intertwine to create a comprehensive investment strategy. However, the landscape is constantly shifting, prompting a need for ongoing analysis. What aspects will emerge as the most critical in this evolving market?

Analyzing Financial Health and Performance Metrics

When evaluating potential investments, analyzing financial health and performance metrics is crucial, as these indicators provide insights into a company's operational efficiency and profitability.

Key metrics, such as profit margins and cash flow, reveal how well a company manages expenses and generates revenue. Strong profit margins indicate competitive pricing, while robust cash flow ensures the company can sustain operations and reinvest for growth.

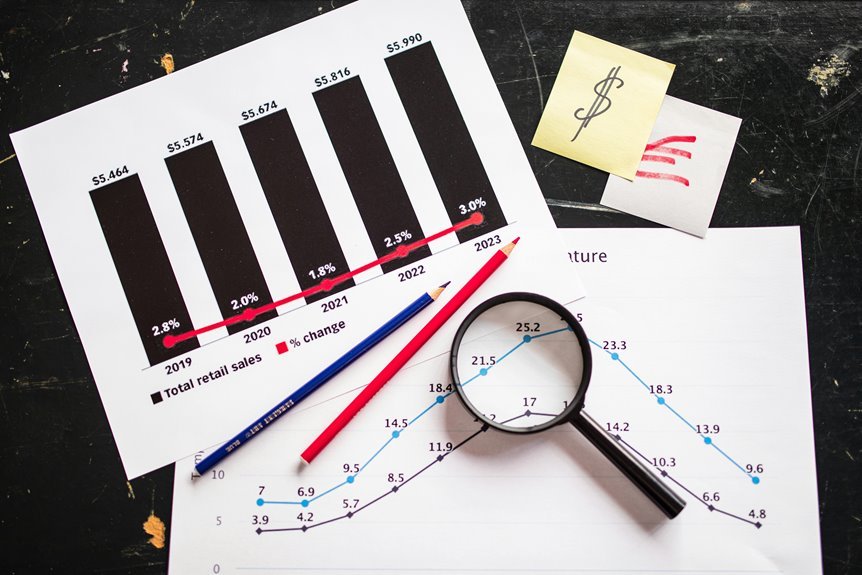

Understanding Market Trends and Economic Indicators

How do market trends and economic indicators shape investment decisions?

Investors must analyze market sentiment and recognize economic cycles to forecast stock performance. Positive trends and robust indicators typically signal growth opportunities, while negative shifts may indicate potential downturns.

Evaluating Industry Dynamics and Competitive Positioning

A thorough evaluation of industry dynamics and competitive positioning is essential for investors seeking profitable stock opportunities.

Understanding industry trends helps identify growth sectors, while competitive analysis reveals a company's market standing.

By examining competitors' strengths and weaknesses, investors can gauge potential for profitability, ensuring strategic decisions align with emerging opportunities.

This analytical approach fosters informed investment choices in a rapidly evolving market landscape.

Conclusion

In conclusion, selecting profitable stocks requires a multifaceted approach, focusing on financial health, market dynamics, and competitive positioning. For instance, companies with profit margins exceeding 20% often outperform their peers, highlighting operational efficiency and market strength. As investors navigate a complex landscape, leveraging these key factors can significantly enhance their decision-making process. By remaining vigilant to economic indicators and industry trends, investors can position themselves to capitalize on emerging opportunities for sustained growth.